Regression Analysis Using SAS

Analysis of a Fitted Multiple Regression Model

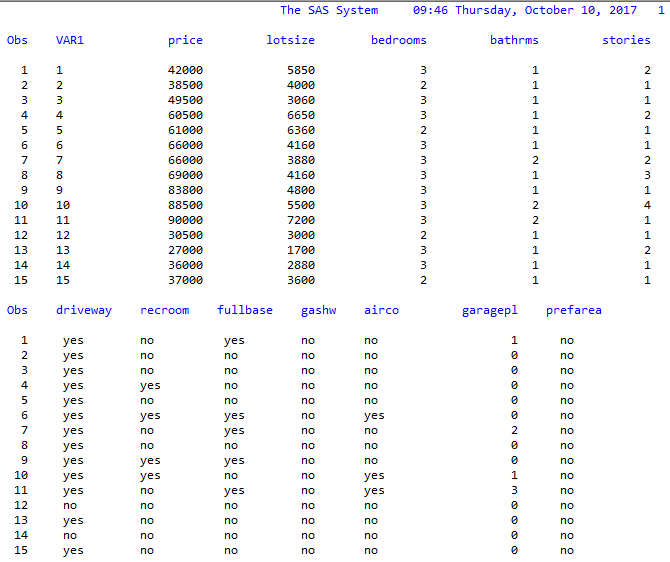

If your “best model” selected in the previous chapter contains more than one x-variable, run that regression model in SAS. If it only has one x-variable, use the best model that had more than one x-variable. Answer the following questions.

- Analysis of Output

(a) The t-tests

(i) What is being tested?

(ii) What are the results of the tests? (Careful, these are partial coefficients.)

(b) The F-test

(i) State the null and alternate hypotheses for your model.

(ii) State the conclusion of the test and the grounds for the decision.

(c) The -equation

(i) State the equation for your fitted model;

(ii) Explain how is related to the E(YX).

- R-square

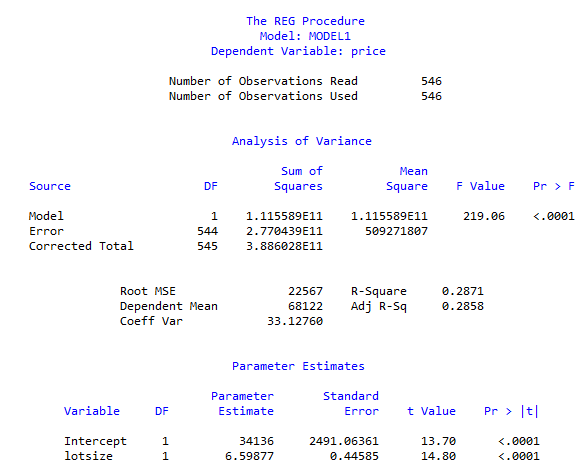

(a) Report the value of R-square;

(b) Show how it was computed from the software output;

(c) Explain the meaning of your R-square using the approach found in Lecture Notes 5.

(d) Give the naïve interpretation of your R-square, as discussed on LN5. - Adjusted R-square

(a) Report the value of the adjusted R-square;

(b) Show how it was computed from the output;

(b) What is the meaning of your adjusted R-square value? - The Partial Regression Coefficients

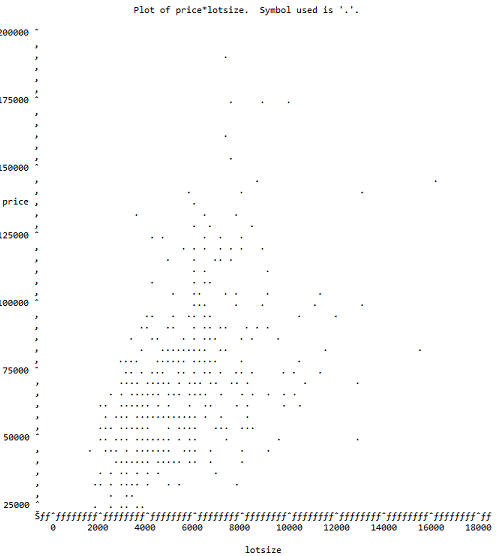

(a) Run the simple regression of y on one of your x-variables from your best model to show that this produces a sample slope coefficient that differs from the partial sample slope coefficient for the same x-variable when your other x-variables are in the model.

(b) Describe the steps by which you can use a series of regressions to compute the above partial regression coefficient for the selected x-variable, above. This involves regressing y on those other x-variables, saving the residuals, and so on, until finally you regress one set of residuals on a second set of residuals.

(c) Demonstrate that what you described in (b) actually works!

(d) Output from SAS the partial R-square and the partial correlations coefficient for the same x-variable on which you analyzed the partial coefficient in your best model.

(e) Using the same approach as in (c), show that the ordinary R-square for the regression of those residuals yields the partial R-square. Likewise for the partial correlation coefficient. - Model Diagnostics

(a) Explain what is shown by Cook’s distance diagnostic plot for your model.

Chapter 7

Run a ridge regression analysis of your data. Try in your own words to explain what that technique does and interpret the output. Supply your own Headers.